Deriv is a well-established online trading platform that has gained widespread recognition for its range of trading instruments, user-friendly platforms, and innovative features. With over 20 years in the industry (starting as Binary.com before rebranding to Deriv), the company provides a robust trading environment suitable for both novice and experienced traders. This review will explore the key aspects of Deriv, including its regulation, account types, platforms, trading instruments, and more.

Regulation and Security

Deriv operates under the oversight of multiple regulatory bodies, ensuring a secure and transparent trading environment for its clients. Below is an overview of the key regulatory bodies that govern Deriv’s operations:

| Regulatory Body | Region | License Number |

|---|---|---|

| Malta Financial Services Authority (MFSA) | European Union | IS/70156 |

| Labuan Financial Services Authority (LFSA) | Malaysia (Asia) | MB/18/0024 |

| Vanuatu Financial Services Commission (VFSC) | Global (Offshore) | 700238 |

| Financial Commission (FinaCom) | Global (third-party resolution) | – |

Client Fund Protection:

- Segregated Accounts: Deriv ensures that client funds are stored separately from company operating funds, reducing risk.

- SSL Encryption: The platform uses advanced encryption protocols to protect sensitive client data.

- Third-Party Resolution: Deriv is a member of the Financial Commission, which offers a neutral third-party resolution in case of disputes between the broker and clients.

Account Types

Deriv offers several account types designed to cater to a wide range of traders, from beginners to experienced professionals.

| Account Type | Minimum Deposit | Spreads | Leverage | Commission | Best For |

|---|---|---|---|---|---|

| Standard Account | $5 | From 0.5 pips | Up to 1:1000 | None | Beginner to Intermediate |

| DMT5 Financial Account | $5 | From 0.2 pips | Up to 1:1000 | $3 per lot | Forex and CFD Traders |

| DTrader Account | $5 | Fixed multipliers | Up to 1:100 | None | Binary Options Traders |

| Synthetic Account | $5 | Varies (Synthetic markets) | Up to 1:1000 | None | Synthetic Indices Traders |

| DMT5 Synthetic Account | $5 | Variable spreads | Up to 1:1000 | None | High-volatility trading |

| Deriv X Account | $5 | From 0.3 pips | Up to 1:1000 | None | Advanced CFD Traders |

Unique Features:

- Low Minimum Deposits: With a $5 minimum deposit, Deriv makes it easy for new traders to get started with minimal financial commitment.

- Synthetic Indices: Deriv offers synthetic indices that are available 24/7, offering constant trading opportunities, even during traditional market closures.

- Flexible Leverage: High leverage options, up to 1:1000, allow traders to maximize their potential earnings, though it’s important to use this responsibly due to the increased risk.

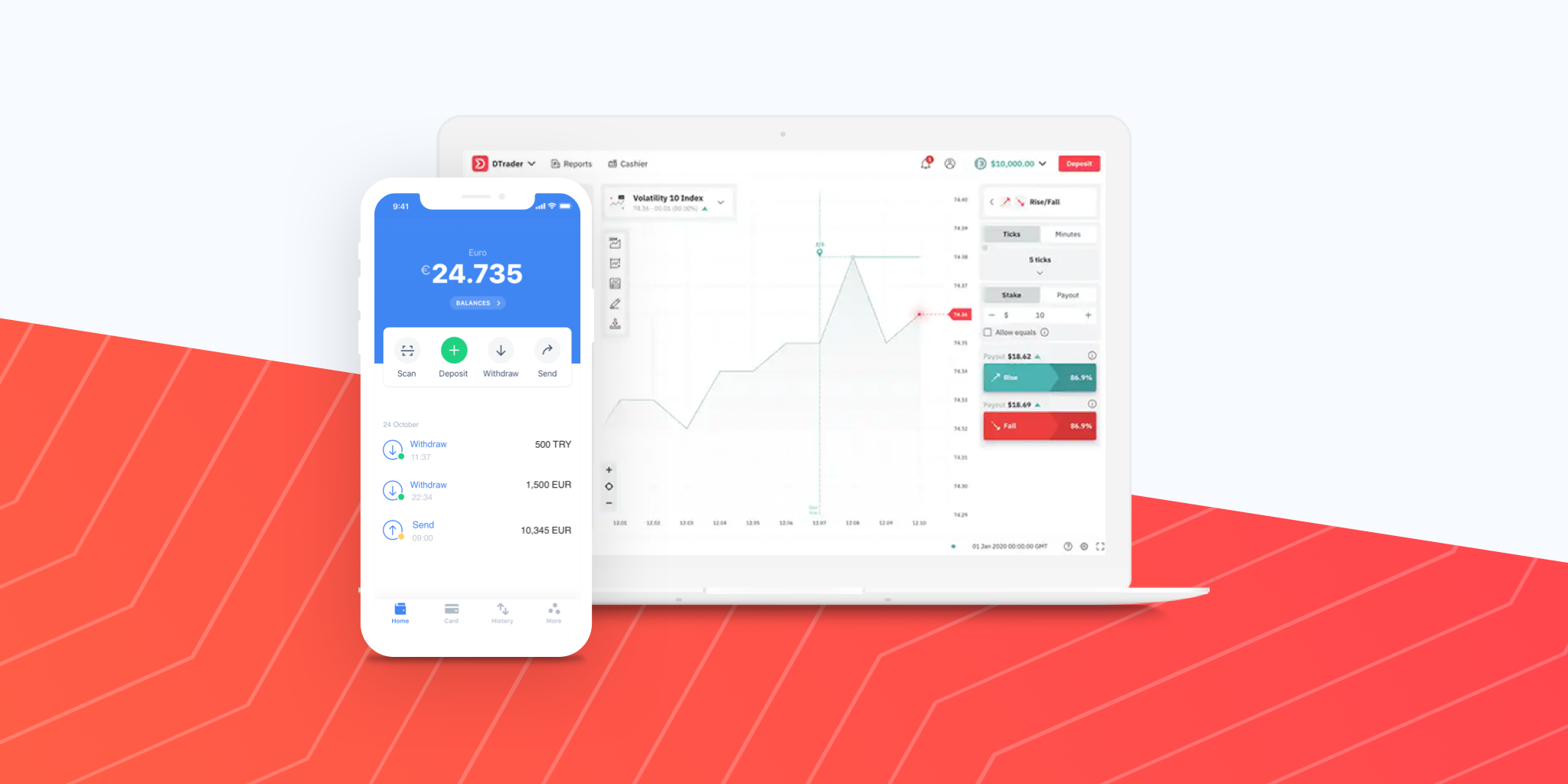

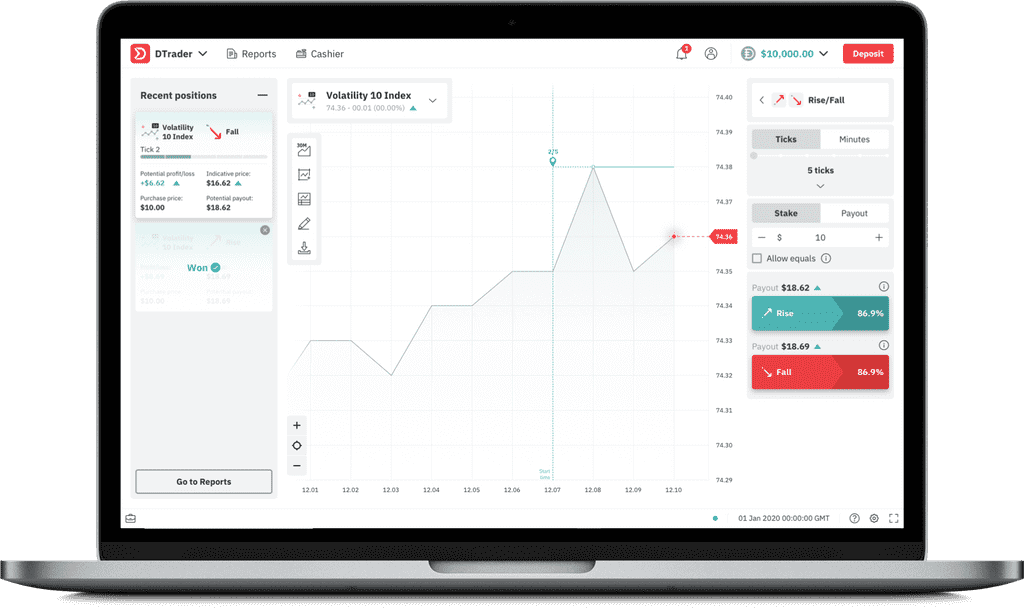

Trading Platforms

Deriv offers several proprietary and industry-standard trading platforms, providing flexibility and customization for traders.

| Platform | Description |

|---|---|

| DTrader | Deriv’s user-friendly binary options platform, offering fixed multipliers and simple charting for beginners. |

| DMT5 (MetaTrader 5) | The standard MT5 platform allows forex, CFD, and synthetic trading with advanced charting and technical indicators. |

| Deriv X | A customizable CFD trading platform offering intuitive charting tools and personalized trading layouts. |

| DBot | An automated trading platform allowing users to build and deploy trading bots without coding knowledge. |

| SmartTrader | A simplified platform for binary options trading, ideal for fast trades with fixed payouts. |

Unique Platform Features:

- DTrader: Ideal for beginners, this platform allows trading on binary options with fixed multipliers, simple charts, and straightforward execution.

- DMT5: Offers multi-asset trading, including forex, stocks, and commodities, with more advanced tools and features for professional traders.

- DBot: Allows traders to build custom trading bots using a drag-and-drop interface, making automation accessible to all.

- Deriv X: A highly customizable platform, allowing traders to adjust the layout to their preferences for optimal trading.

Trading Instruments

Deriv offers an impressive range of financial instruments, allowing traders to diversify their portfolios and explore multiple markets.

| Asset Class | Instruments Available | Examples |

|---|---|---|

| Forex | 50+ currency pairs | EUR/USD, GBP/JPY, AUD/CAD |

| Synthetic Indices | 6 synthetic markets | Volatility Index 75, Boom 500 Index, Crash 1000 |

| Commodities | Gold, Oil, Silver | Crude Oil, Brent, Natural Gas |

| Indices | 10 major global indices | S&P 500, NASDAQ 100, FTSE 100 |

| Cryptocurrencies | Major cryptocurrencies | Bitcoin, Ethereum, Litecoin, Ripple |

| Stocks (CFDs) | 100+ stock CFDs | Apple, Tesla, Google |

| Binary Options | Fixed-payout trading | Contracts for forex, indices, and commodities |

Unique Trading Instruments:

- Synthetic Indices: Deriv is known for its unique synthetic indices, which simulate real-world market conditions but are independent of actual market events. These indices are available 24/7 and are ideal for traders looking for high-volatility trading.

- Binary Options: Deriv continues to offer binary options (fixed-payout trades), making it one of the few brokers that still supports this trading style, which can be highly profitable for those who understand it.

Spreads and Fees

Deriv offers competitive spreads and fees across all its account types. Below is a comparison of typical trading costs:

| Account Type | Typical Spread (EUR/USD) | Commission | Leverage |

|---|---|---|---|

| Standard Account | From 0.5 pips | None | Up to 1:1000 |

| DMT5 Financial | From 0.2 pips | $3 per lot | Up to 1:1000 |

| DTrader | Fixed spreads for options | None | Fixed multipliers |

| Deriv X | From 0.3 pips | None | Up to 1:1000 |

| Synthetic Accounts | Varies depending on volatility | None | Up to 1:1000 |

Key Cost Features:

- No Withdrawal Fees: Deriv does not charge any fees for deposits or withdrawals, regardless of the payment method used.

- Tight Spreads: For forex trading, spreads start as low as 0.2 pips, making Deriv a cost-effective platform for traders looking to minimize expenses.

- Commission-Free Accounts: Most accounts are commission-free, with the exception of the DMT5 Financial account, which charges a small commission of $3 per lot.

Customer Support and Educational Tools

Deriv offers 24/7 customer support across multiple languages, ensuring that traders can get assistance whenever they need it. The broker offers the following support channels:

| Support Channel | Availability | Languages Supported |

|---|---|---|

| Live Chat | 24/7 | Multiple languages |

| 24/7 | Multiple languages | |

| Phone Support | 24/5 | Limited languages |

Educational Resources: Deriv offers a range of educational tools, helping both beginners and experienced traders enhance their skills.

| Resource Type | Description |

|---|---|

| Webinars | Regular webinars covering trading strategies and market updates. |

| Video Tutorials | Step-by-step guides to using the platforms and trading basics. |

| Market Analysis | Daily news and analysis on major global markets. |

| Trading Glossary | A glossary of common trading terms and definitions. |

Pros and Cons of Deriv

Pros:

- Regulated by multiple authorities: Deriv operates under respected regulatory bodies, providing a safe and secure environment.

- Wide range of trading instruments: From forex and synthetic indices to commodities and cryptocurrencies, Deriv offers a comprehensive selection of instruments.

- Low minimum deposit: With a minimum deposit of just $5, Deriv is accessible to new traders.

- 24/7 synthetic index trading: Deriv’s synthetic indices allow traders to trade around the clock, even on weekends.

- Multiple platforms: Deriv offers a wide array of trading platforms, including MetaTrader 5, DTrader, and Deriv X.

- No deposit/withdrawal fees: All deposits and withdrawals are fee-free, regardless of payment method.

- Automated trading with DBot: Deriv allows traders to build and deploy bots without needing programming knowledge.

Cons:

- Limited asset range compared to major brokers: While Deriv offers a wide range of synthetic indices and forex pairs, the offering of traditional asset classes like ETFs and bonds is limited.

- No U.S. clients: Due to regulatory restrictions, Deriv does not accept clients from the United States.

- No PayPal support: Although Deriv offers several payment methods, PayPal is not supported.

- Limited advanced trading tools: Some platforms, like DTrader, may not be as comprehensive for advanced traders seeking detailed charting tools and indicators.

Final Verdict

Deriv is a versatile and highly accessible broker, offering a broad range of trading instruments and platforms that cater to traders of all experience levels. Whether you’re a beginner looking to explore binary options or a professional trader seeking to trade on MT5 with tight spreads, Deriv provides an environment that supports both. With its low minimum deposits, 24/7 trading on synthetic indices, and competitive fees, Deriv is well-suited for traders looking for flexibility and affordability.

Strengths:

- Regulation and security ensure traders’ peace of mind.

- Synthetic indices offer unique trading opportunities 24/7.

- Low fees and automated trading options make Deriv a great choice for cost-conscious and tech-savvy traders.

Opportunities for Improvement:

- Expanding its range of assets (e.g., ETFs, bonds) and payment methods like PayPal could broaden its appeal to more diverse traders.

Conclusion: Deriv is a well-rounded broker that blends traditional and modern trading styles, appealing to those looking for flexibility, low costs, and innovative trading solutions.

Risk Disclaimer

Trading CFDs and binary options involves a high level of risk and may result in the loss of your capital. Leverage can amplify both profits and losses. Ensure that you fully understand the risks involved before trading and consider seeking independent financial advice if necessary.

.webp)